Just three years ago, AT&T bought Time Warner for an eye popping $85 billion. Now it is spinning off the very same assets to Discovery for less than half ($43 billion).

Given the abrupt turnaround. The press is having a field day criticizing AT&T.

But this article isn’t another hit piece.

Instead, this situation provides a perfect example of why it is critical to test your ideas before you decide to invest an arm and a leg.

In this instance, there were 3 small, quick, and cheap experiments AT&T could have run to help them validate the idea.

The insights gained from these experiments would have saved them $83 billion, three years, and a whole lot of public embarrassment.

So let’s dig into the details, shall we….

According To Most Pundits, AT&T’s Acquisition Of Time Warner Failed Because It Was A Flawed Idea

In 2018, AT&T acquired Time Warner for $85.4 billion.

The acquisition was based on a simple premise:

By bundling cell phone plans (AT&T’s traditional business) with exclusive content (Time Warner’s extensive video library), AT&T would attract more customers, steal market share, and change the very nature of their industry.

While on paper (business case, focus groups, and market research), the idea looked good. In reality, the flood of customers never materialized.

As a result, most experts (here, here, and here) blame AT&T for having a bad idea.

I Disagree. It’s Not About The Idea. My Issue Is With The Size Of The Bet

AT&T’s goal was nothing short of transforming the very nature of the telecom, technology, and streaming services industry.

They wanted to provide customer with new choices that would inject growth and blow the competition away.

In my opinion, this was a bet worth taking. What I disagree with is the size of the bet.

What hurt AT&T is not the idea. But that they invested $85.4 billion on an untested idea.

The Problem With Making A Big Bet On An Untested Idea Is That…

- Mistakes Are Costly: When it comes to new ideas, the odds are already stacked against you. 9 out of 10 ideas fail. Making a big bet does not change the odds in your favor. It only ensures that when things don’t work out, it will be costly.

- Inefficient: Investing a ton of resources first and then determining the viability of the idea is the complete opposite of lean and agile thinking. In fact, this by far is the most expensive, time consuming, and inefficient way to test out an idea.

- Hard To Pivot: Since big bets require large teams, lots of planning, and a ton of inter dependencies. Course correcting is not easy. By the time you find out that you are off course, it may be too late, too expensive, or too hard to change.

- Going Big Is Distracting: Big decisions come with a lot of overhead. With AT&T it meant dealing with culture, assimilating systems,dealing with regulators etc. While they are all necessary. They are also a distraction. You loose focus.

- Carries A Huge Opportunity Cost: While you are busy implementing the big idea, think about all the things that you were not able to do. In AT&T’s case, what opportunities did they miss out?

A Better Approach Is To Test The Idea First (i.e Run Small Experiments)

AT&T could have taken a page from how startups and digital natives approach big bets.

They rarely make them outright.

Instead they prefer to,

- Identify their riskiest assumptions

- Run experiments to test their riskiest assumption.

- Decide their next steps (pivot, iterate, or scale) based on the results of the experiments (data)

For example, Zappos Started As A Test

In 1999, founder Nick Swinmurn, had an idea of selling shoes online. But he was not sure if consumers would be open to buying shoes online.

While it may seem inevitable to us us now. Back then it was a big gamble.

So instead of building first (buying inventory, creating an online store, standing up back end operations) and hoping that the customers would show up.

Nick decided to run experiments to test his riskiest assumption.

He headed out to his local mall, photographed pairs of shoes, and posted them for sale on his website. When a customer placed an order, he would head back to the store, buy the shoe and Zappos would ship it.

While this was obviously not a viable way to run a business. It proved to Nick that he had a viable business idea.

The experiment helped him de-risk his big bet. Gave him insight on consumer behavior. And most importantly, allowed him to invest in his idea with confidence.

Today, Zappos has over 50,000 clothing items for sale and $2 billion in annual revenue.

Zappos Is Not The Only One Who Has Benefited From This Approach

Drop Box, Groupon, Gmail, AirBnB, Buffer, and countless others have done the same.

They identify the riskiest assumption, run experiments to test it, and let the data guide their next decision.

AT&T Could Have Done The Same

If AT&T was to follow the silicon valley playbook, it should have…

1. Identified The Riskiest Assumptions

There are lots of risks when it comes to an acquisition – from integration, technical, financial, cultural etc.

Yet for AT&T the entire bet hinged on the following assumption:

Customers would buy the new combined bundle (AT&T’s Nationwide Service + Time Warner’s Premium Content)

You can see this assumption front and center in their original press release.

Get this assumption wrong and the whole thing falls apart.

2. Run Experiments To Test These Assumptions

Digital natives leverage experiments as a quick and efficient way to test thier assumptions (hypothesis) without building the actual product / solution.

AT&T could have done the same.

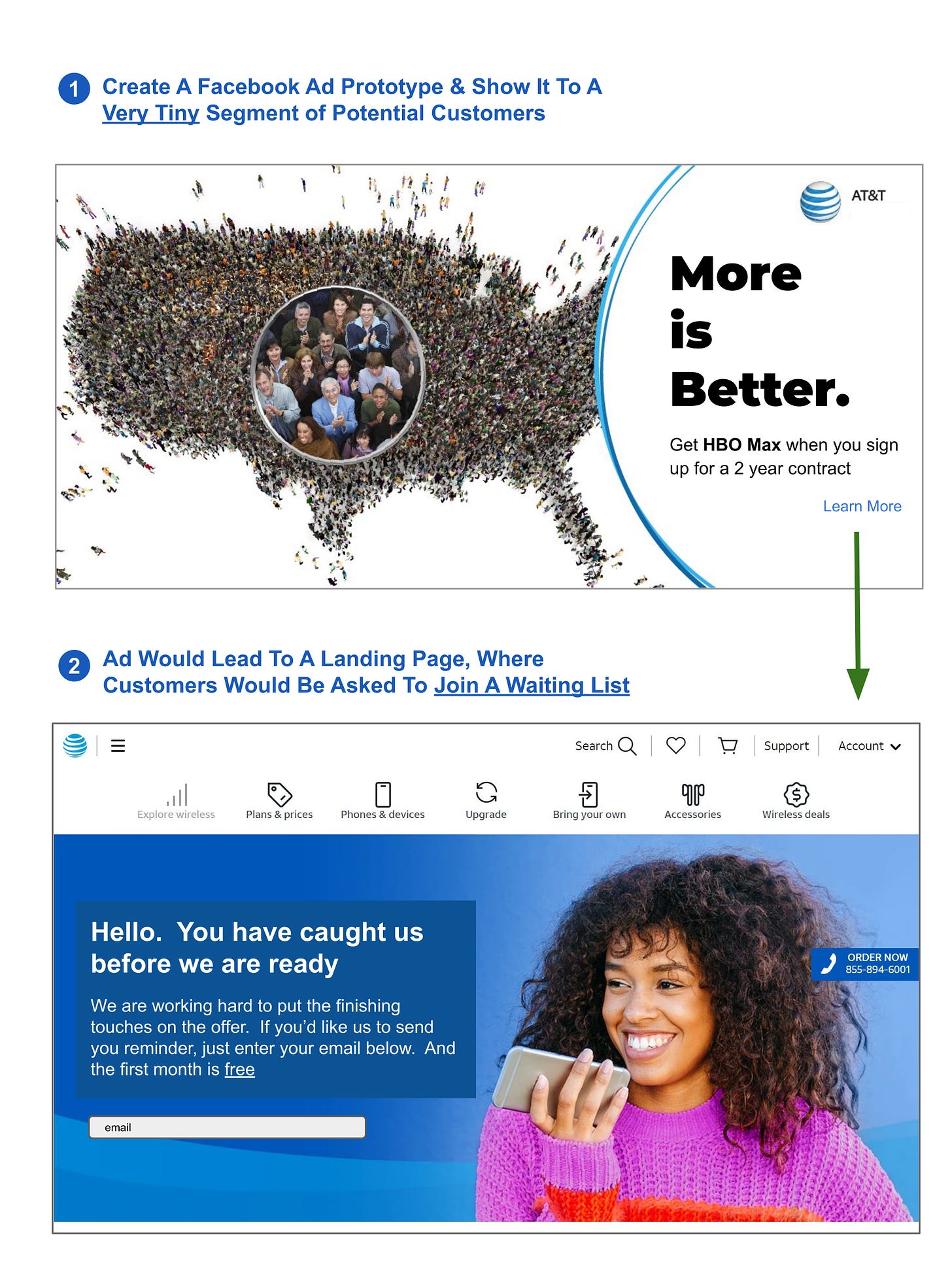

Experiment 1: Simulate An Online Campaign To Determine Customer Interest

To test the above assumption, AT&T could have run the following online experiment.

To keep the blast radius small. AT&T would advertise only in a few places, target a handful of ideal customers, and run the ads only for a week or two.

The benefit of an online experiment is that it helps determine customer interest against real life conditions.

By placing ads on Facebook, AT&T is capturing customer behavior not just on its new bundle, but also against competitors current promotions, AT&T’s current promotions, and all the daily “distractions” a customer have to wade through.

Based on the responses – ad clicks, emails collected, location, demographics etc. The experiment would have given AT&T an early indication of how their idea would fare in the real world.

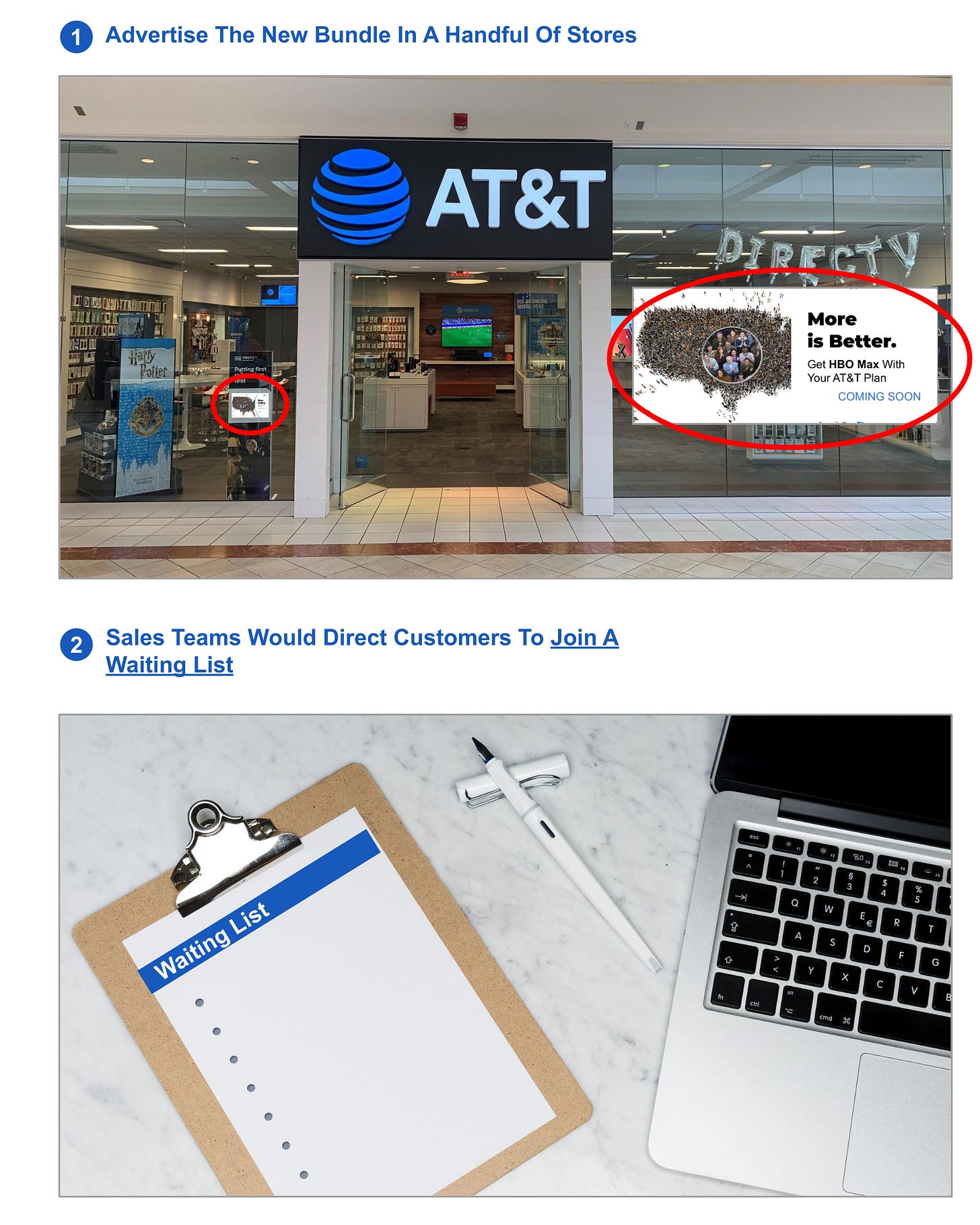

Experiment 2: Simulate An Offline Campaign To Determine Customer Interest

In addition to using an online channel, AT&T could have also run a similar experiment in a handful of stores.

The benefit of adding an offline experiment is two fold.

First, it simulates customer behavior in a real store environment. A place where customers make buying decisions day in and day out.

Second, it also provides greater insight into which marketing channel is more effective.

As for the experiment itself.

AT&T could have repurposed the Facebook ad, turned it into marketing posters, and placed them in a handful of stores.

Five to ten stores in key demographic locations, is usually good enough to run a test.

And like before, based on the customers reaction – how many picked up the flyer, asked a sales clerk, or added their name to the waiting list etc. AT&T would have been able to quickly gauge customer interest.

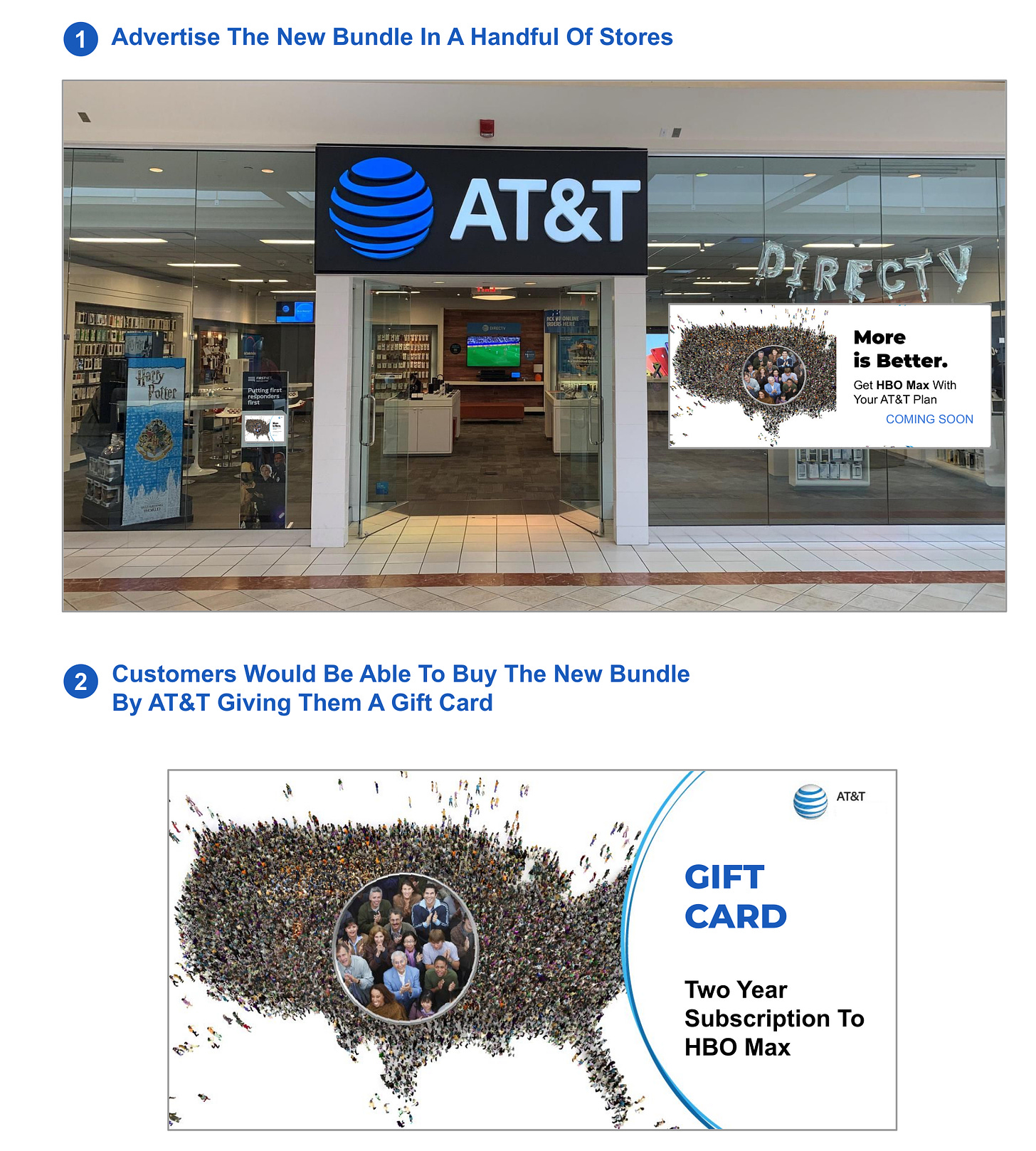

Experiment 3: Sell A Close Enough Substitute To Test If Customers Will Buy

If AT&T wanted to push the envelope and see if interested customer would buy the bundle. They could have done what Zappos did.

Instead of asking the customers to sign up on the waiting list. AT&T could augment their current phone plan with a Time Warner subscription gift card.

The benefit of this approach?

It is as good as it gets. There is no greater proof than when a customer is willing to part with their money.

Similar approach could work for Experiment #1 as well.

3. Let Data Guide Their Next Steps

Based on the (lack of) results AT&T could have decided to,

- Further customize the experiments and expand the blast radius. So that they can get more data that would either confirm or deny the earlier results.

- Leverage this as a learning opportunity. Based on customer feedback, they could have iterated on the value proposition, and ultimately discovered the “right” bundle.

- Abandon the bet (there is no shame in reading the market wrong) and saved themselves tremendous amount of pain and humiliation.

Either way, they would have come out much more ahead then the present situation.

But Wait….What About Traditional Market Research Methods, Is’nt That Suppose To Test The Idea

I know what you are thinking.

Why go through all this trouble? After all, wouldn’t traditional market research be enough to test the idea.

Fair question.

The benefits of conducting experiments over traditional market research are three fold.

First, real customers. AT&T gain’s feedback from customers who are in the process of buying. Not a “persona” who is getting paid to sit through a “hypothetical” market research questionnaire.

Second, the right environment. By running experiments in stores and online, AT&T is recreating the real buying environment. Something that is impossible to do in a sterile focus group room.

Third, first hand observation. Having AT&T’s product managers run, watch, and evaluate the experiments provides them with deeper insights. It’s not about skimming a 30 page market report that tells you what you want to hear. There are no middle men massaging the data. And nothing is lost in translation.

As a result the data you receive through experimentation is much richer, deeper, closer to reality and (most importantly) actionable.

Does This Mean That AT&T Should Have Skipped Market Research All Together?

Of course not. The research still has many additional benefits.

Yet when it comes to testing assumptions. There is no substitute for running experiments that simulates the real thing.

So What Does All This Mean For You

The next time you have a big bet, try not to do what AT&T did.

Instead of betting the farm, consider de-risking your big bet first. Identify your key risks, run a few experiments, and let the data guide you to the next step.

Disclaimer: Analysis is based on publicly available information only. I have no inside information on the AT&T and Time Warner acquisition. All images are illustrative.